Overview

Role:

Lead Product DesignCustomer problem:

Customers were only able to close an account using a browser, and even then the process could be confusing.Business goal:

Improve customer trust

Restore reputation

Reduce costProcess:

Understand customer pain points

Understand current technology and constraints

Cultivate partner relationships

Show immediate velocity

Understand how to flex the existing techSolution:

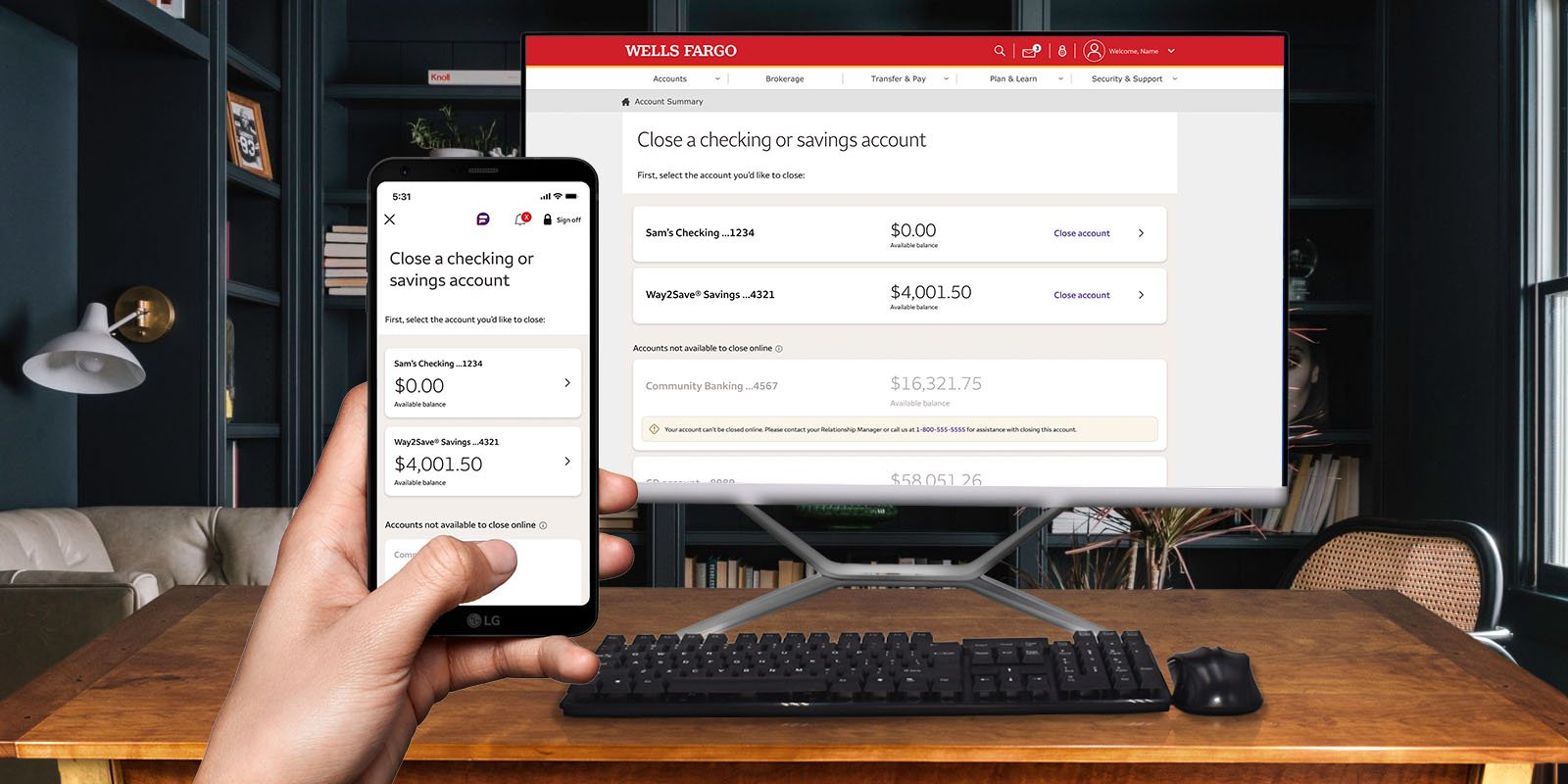

Delivery of the of the Account Closure MVP across native platformsImpact:

Massive increase in account closure success rate

Reduced customer support cost

Rebuilding Trust Through Better Digital Experiences

When unauthorized account openings led to frustration and regulatory scrutiny, Wells Fargo faced the challenge of rebuilding trust. Leadership changes and policy fixes were a start, but real progress required giving customers more control and transparency. This case study explores how redesigning the digital account closure process helped restore confidence and empower customers.

Problem Statement

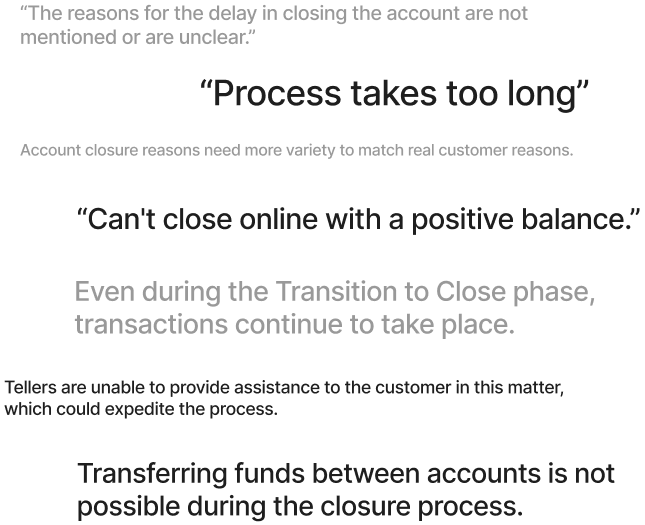

“Accounts could not be successfully closed through the app, which led to frustration. Customers needed to have a $0 balance to be eligible to close online, and additionally there were confusing situations and technical issues that further prevented closing online."

Due to a number of blockers, most customers closing an account online would fail, resulting in tedious customer support calls and visits to a branch. For the few customers who managed to close an account, the process was full of redundancies and was complicated, creating a time-consuming experience. This inefficiency not only frustrated customers but also placed additional strain on customer service resources, highlighting the need for a more streamlined and user-friendly approach to account management.

The Opportunity

Increase online close opportunity

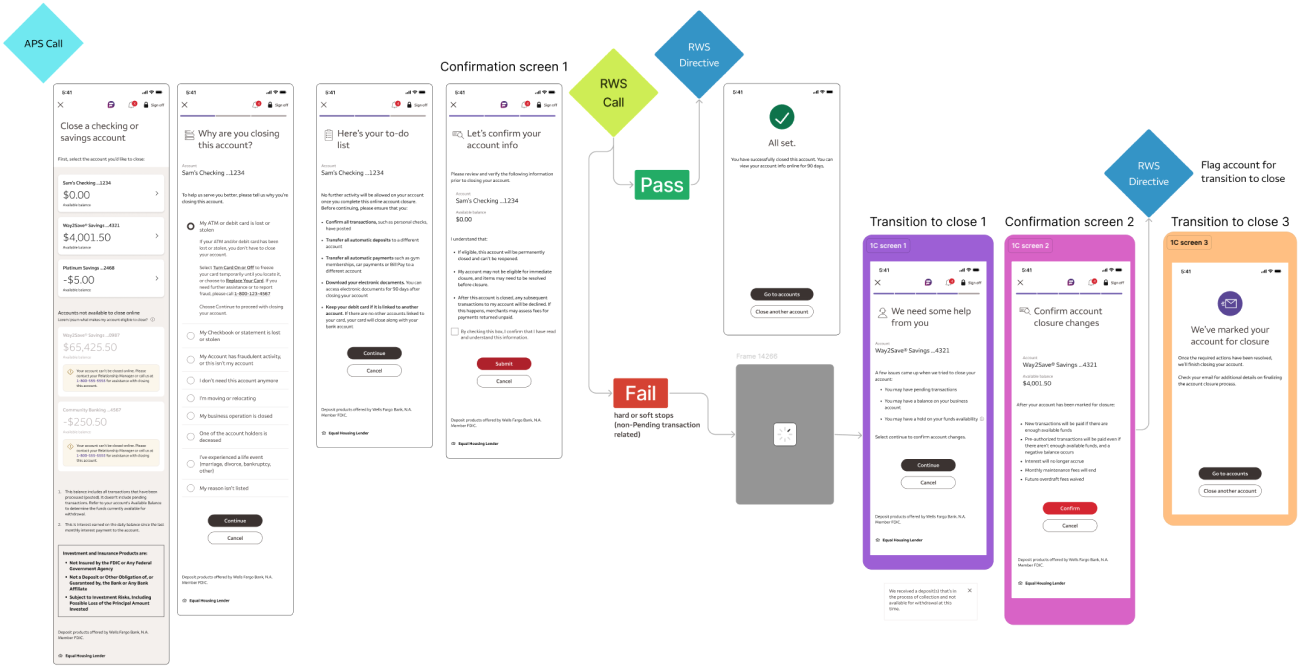

Give customers the tools they need in the closing process to help themselves; Boosting the success rate from only a few to almost all (Saving WF millions of dollars per quarter in call center expenses)User-friendly design

Streamline the user experience and revise the language to be more conversational and less formal.Reduce cost to the bank

The high number of customers that could not close accounts online was reflected in the number of customer support costs incurred.Rebuild customer trust and bank reputation

In light of Wells Fargo account scandal, it was crucial to streamline the procedure for closing accounts as this would significantly contribute to rebuilding trust with our customers.

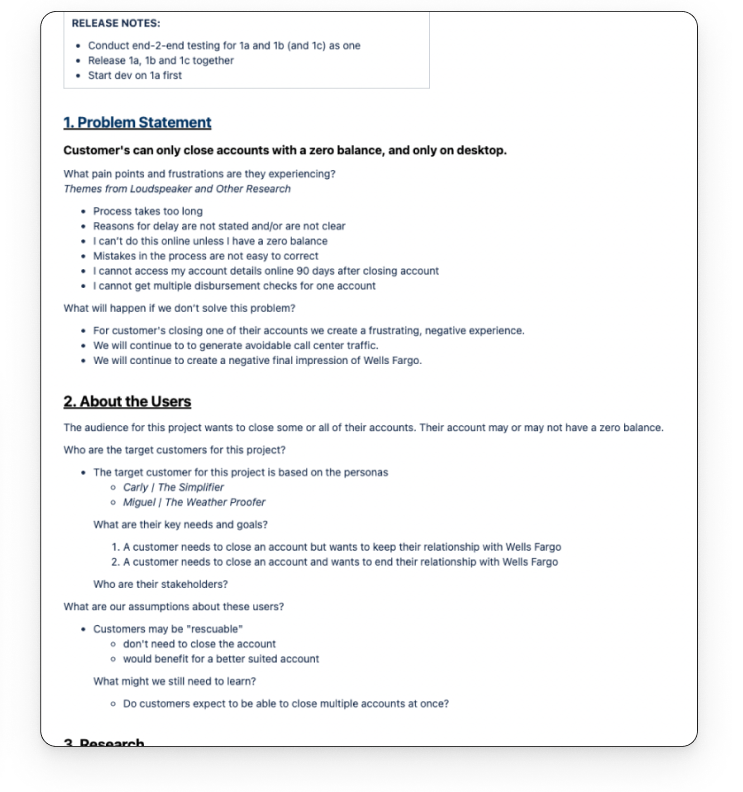

UX Design Brief

Identifying what I know, what I don’t know, and what I need to know.

Following a meeting with my product partner, I draft my standard UX design brief to document the project through the UX team’s understanding of the project.

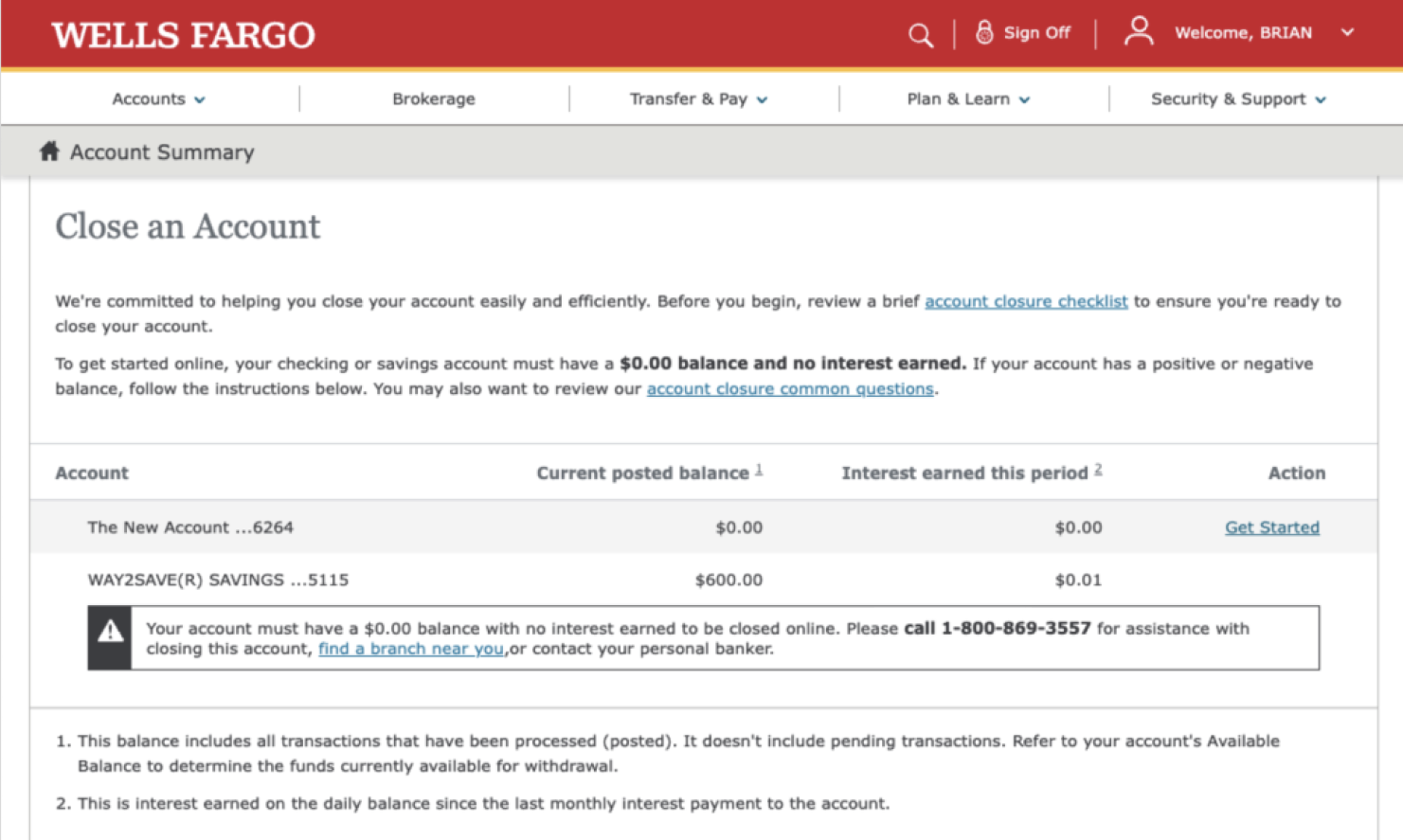

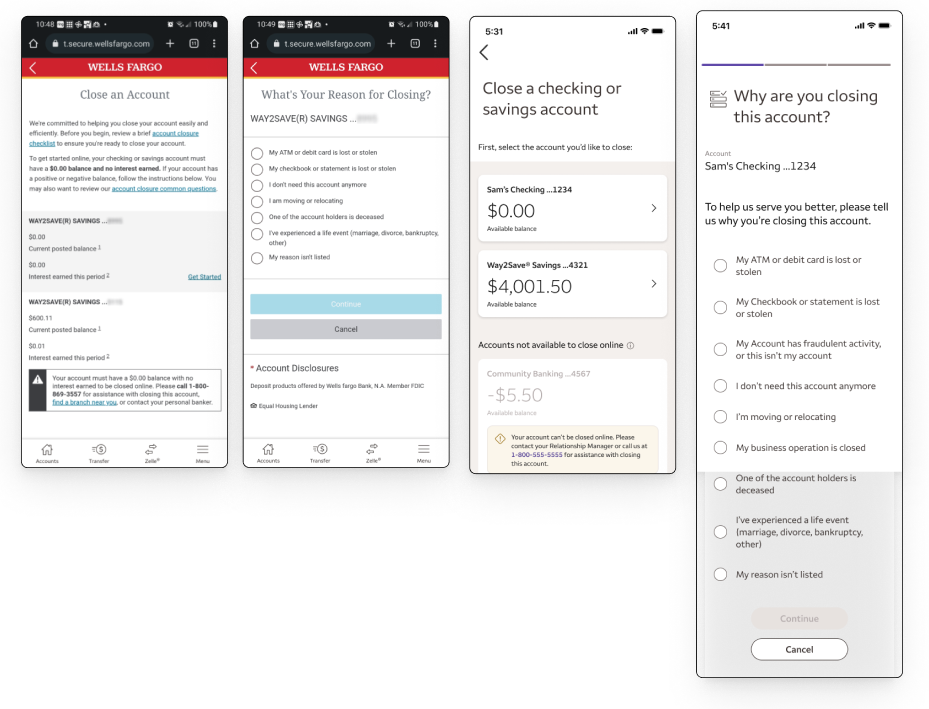

“Lift & shift”

In order show immediate progress to our leadership and business partners, we updated the look and feel with components from our responsive design system and began to explore where and how we could improve the voice of the experience.

Ensuring customer success

Getting rid of the zero-balance rule

To figure out what customers needed to succeed, we had to know what was holding them back.

The majority of customers couldn't close due to having a balance greater than zero. In addition to that a percentage of customers were unable to close their account due to issues associated with the account itself.

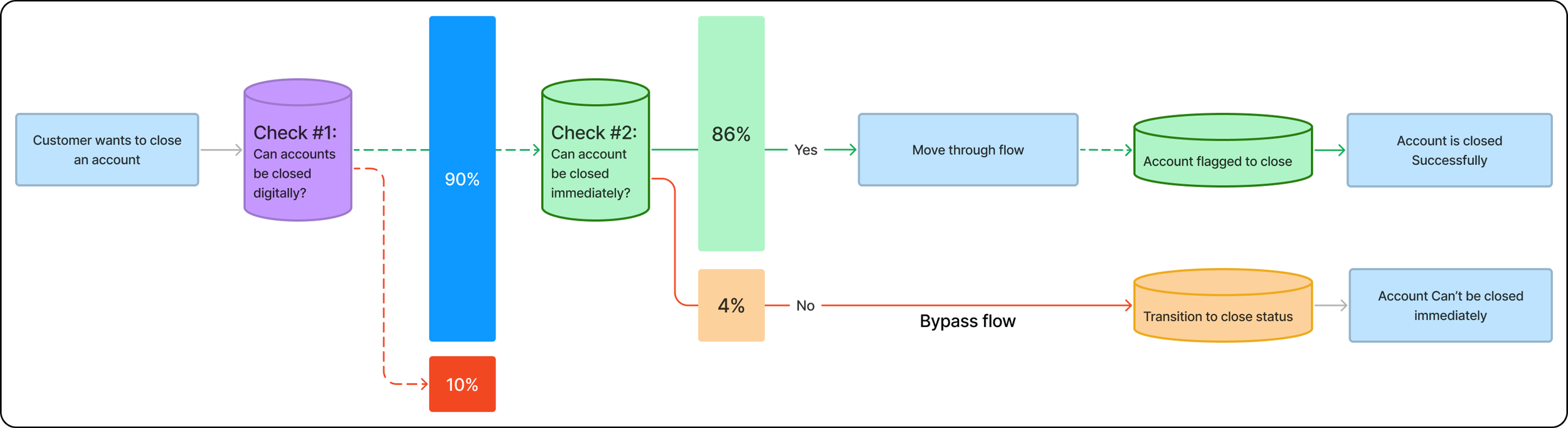

A strategic pivot

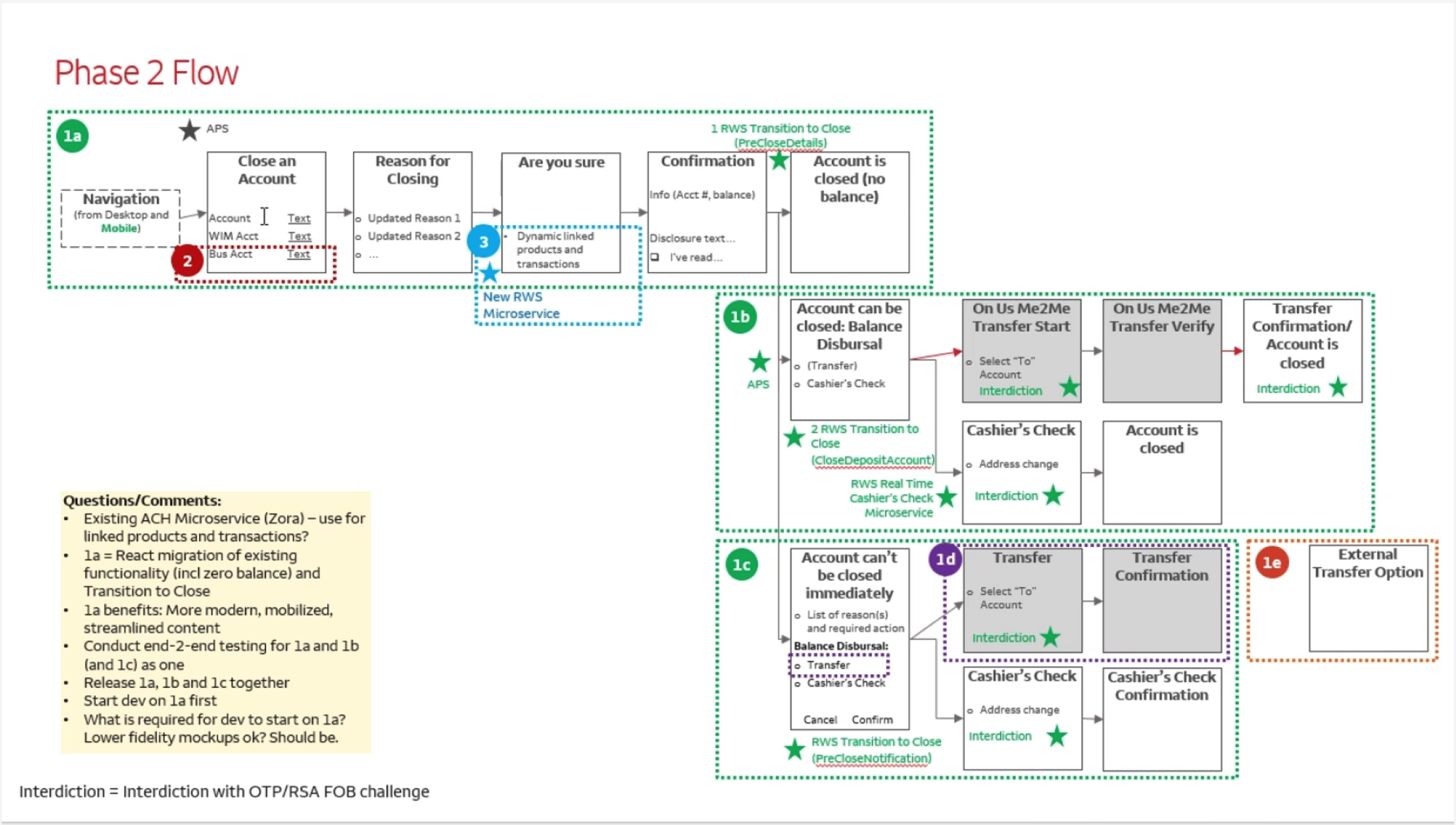

Technology constraints

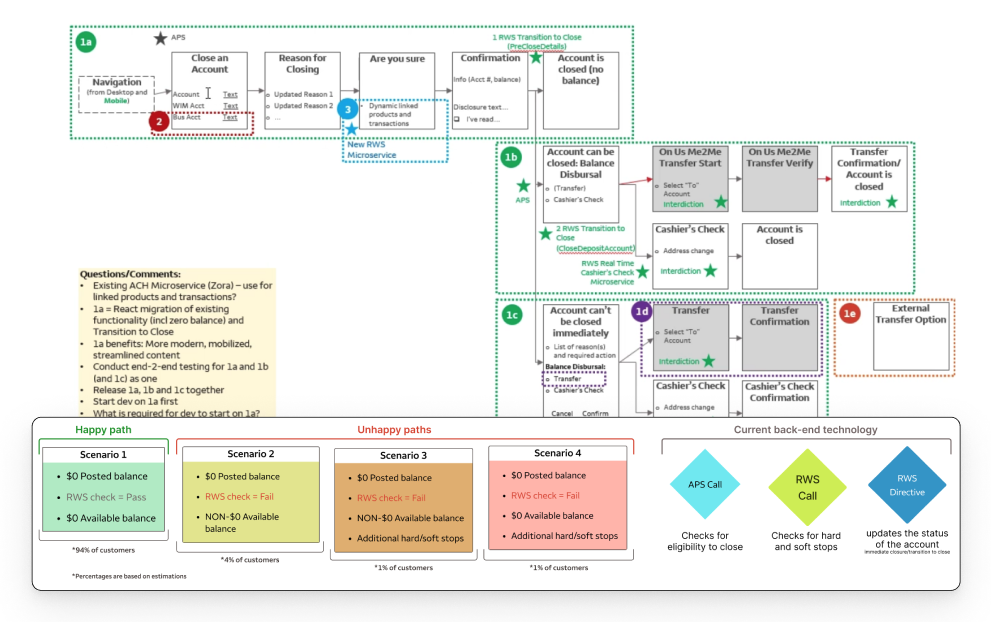

During our discussions with business partners, we discovered that accounts undergo verification for closure eligibility at two key stages within the process:

right at the start and right at the conclusion.

Uncovering this allowed me to identify an opportunity to improve the overall experience, but it would require an upgrade to our tech stack.

Limited engineering resources

Updating any of our technology would require too much time for us to meet our target date.

Utilizing current tech

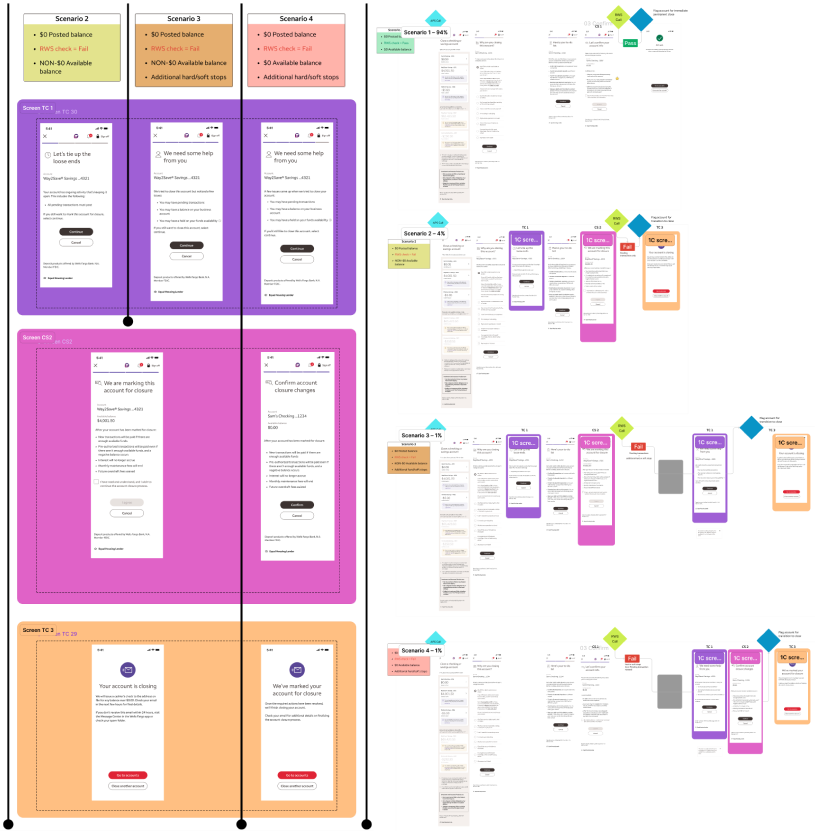

Supporting a four-scenario solution

Scenario 1

Zero-balance customer can close immediately.

Scenario 2

Customer has a positive balance, requiring disbursement of funds.

Scenarios 3 & 4

The customer needs to deal with other issues, no matter the account balance, before they can close the account.

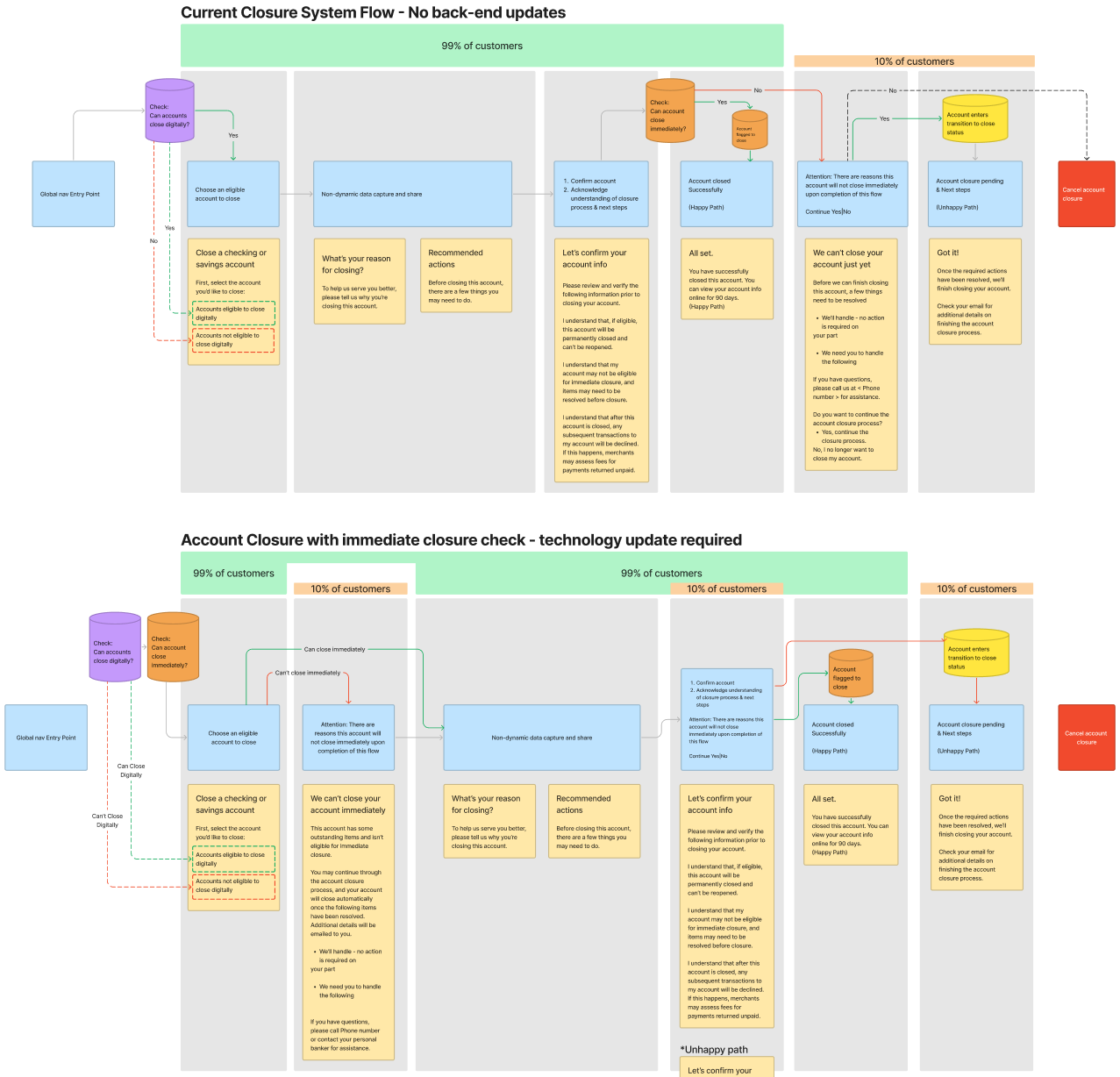

A conditional experience

To help our new approach without a tech upgrade, I figured out how we could use a modular flow with conditional logic to support our 4 situations better.

Our solution

Outcomes

Massive increase

Achieved a significant improvement in the success rate of customer account closures, increasing it from barely any to almost all.Native app support

The majority of our mobile app users can now close their account in-app.Improved UX

Streamlined, user-friendly experience with modern visual aesthetic for positive user interaction.Reduced Customer Support Costs